The Only Guide for Offshore Trust Services

Wiki Article

The Best Guide To Offshore Trust Services

Table of ContentsOffshore Trust Services Fundamentals ExplainedOur Offshore Trust Services IdeasFacts About Offshore Trust Services UncoveredOffshore Trust Services Fundamentals ExplainedTop Guidelines Of Offshore Trust ServicesGetting My Offshore Trust Services To Work

, the trust fund act will certainly detail just how the foreign trustee must use the count on's assets.The Internal Revenue Solution has boosted surveillance of overseas trusts in recent years, and conventional tax legislations still use.

The smart Trick of Offshore Trust Services That Nobody is Discussing

Expensive trustee charges can trigger your overseas possession security worth to reduce with time, clearing up costs a need for a high quality depend on company. In the net age, it's simple to locate consumer reviews on any type of offered company. Testimonials alone may not guide your choice, however reviewing former customers' experiences might aid you detail concerns to ask prospective trustees as well as compare business.Several legal entities supply their customers asset security solutions, yet the top quality of a possible trustee will certainly depend on their experience with different kinds of trusts. Somebody who wants to develop a small family trust will have different lawful requirements than someone looking for financial investment possibilities. It would certainly be best if you found a trustee that can fulfill the assumptions for count on monitoring according to your objectives.

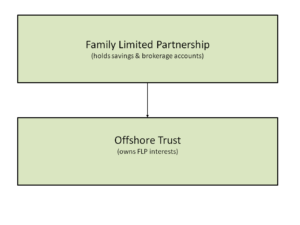

An is a lawful tool that permits an individual to securely secure their assets from creditors. An overseas count on jobs by moving ownership of the properties to an international trustee outside the territory of U.S. courts. While not needed, typically the offshore trust only holds possessions situated beyond the United States.

What Does Offshore Trust Services Mean?

Chef Islands trusts can be made to protect all count on properties from U.S. civil creditors. The trustmaker appoints a trustee that is either an individual person of a foreign country or a trust fund business with no U.SThe trust fund must state that the location of the trust (called the situs) governs trust fund provisions.

The Best Strategy To Use For Offshore Trust Services

Removes your assets from oversight of state courts. Allows you to find more distribute your assets appropriately upon your fatality.

realty for an offshore count on or an overseas LLC, an U.S. court will certainly still have jurisdiction over the borrower's equity and also the property title because the property remains within the united state court's geographical jurisdiction. Offshore preparation may shield U.S. building if the home is overloaded by a mortgage to an offshore financial institution.

The smart Trick of Offshore Trust Services That Nobody is Talking About

A potential debtor can borrow funds from an overseas financial institution, hold the funds offshore in a CD, as well as secure the car loan with a lien on the property. The funding earnings may be held at an U.S. financial institution that is immune from garnishment, albeit making reduced rate of interest rates however with more hassle-free access to the money.A trust guard can be given the power look what i found to alter trustees, reapportion helpful passions, or route the financial investment of trust assets. Advisors may be foreign or U.S. persons that have the authority to route the investment of count on properties. An overseas trust safeguards a United state debtor's assets from United state civil judgments mostly since the count on's properties and its trustee are located beyond the lawful reach of U.S.

U.S. judges have courts authority to compel a force trustee overseas take any action any type of activity assetsTrust fund

Chef Islands count on business are trustworthy, knowledgeable, and also extensively experienced. The Chef Islands are well-regarded as the premier area to establish up an overseas depend on. As one of the original countries with positive overseas trust legislations, the Chef Islands have al lengthy background of court choices i loved this supporting the protection managed by its trusts.

Report this wiki page